MOBILE wallets are the preferred choice for Fijian consumers when accessing local digital financial services or DFS.

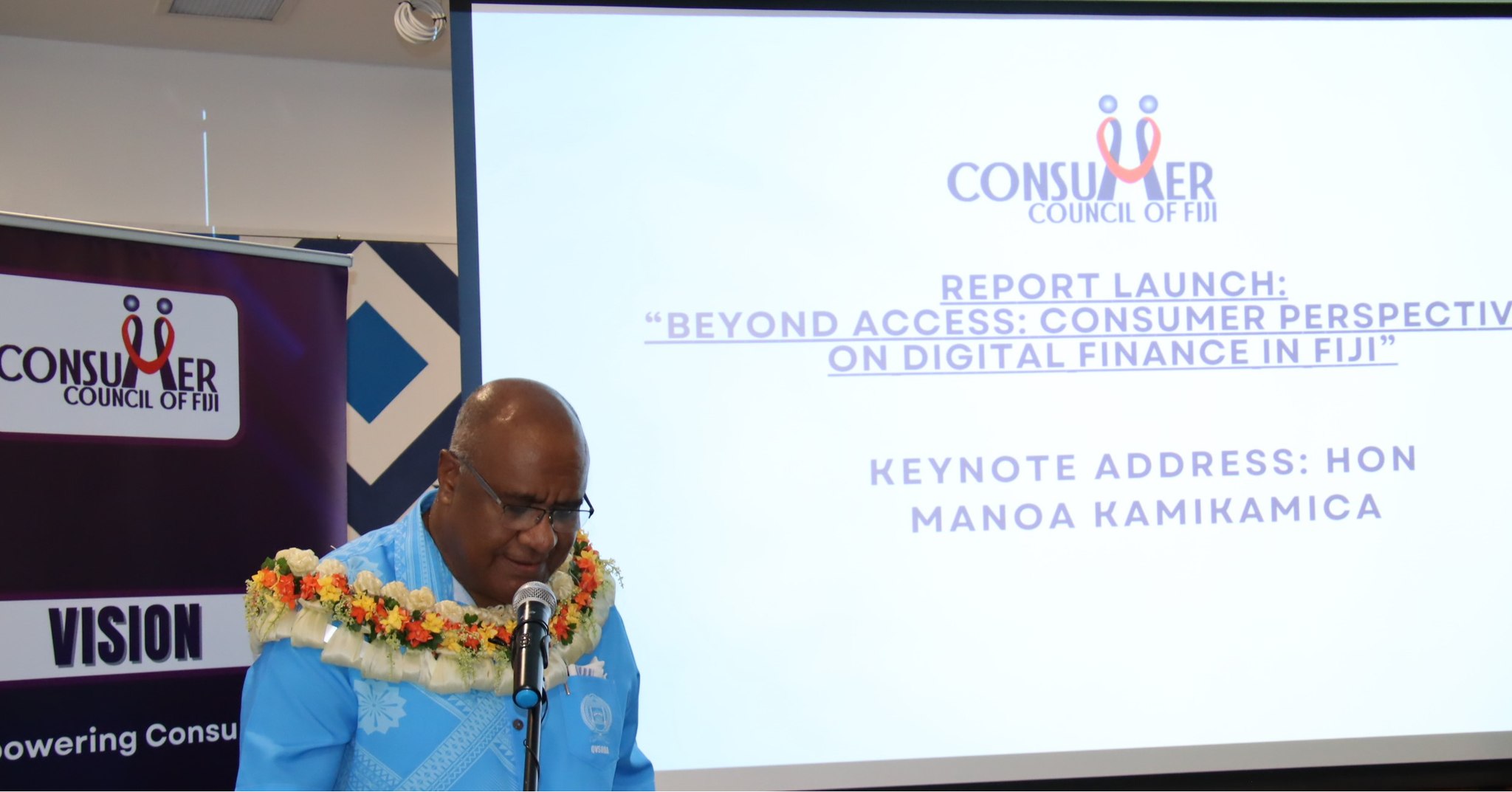

This was revealed in recent survey conducted by the Consumer Council of Fiji (CCoF), the result of which were detailed in a report titled: ‘Beyond Access: Consumer Perspectives on Digital Finance in Fiji 2024’, launched this week in Suva.

The survey found that more than 51 per cent of respondents use mobile wallets, closely followed by Electronic Funds Transfer at Point of Sale (EFTPOS), with a user-base of 24 per cent.

This, the report stated, aligned with data from the Pacific Payment Systems Project (PPSP) which emphasised the growing importance of digital payments in the retail sector across the Pacific region as consumers are increasingly opting for contactless and secure payment methods offered by EFTPOS.

The survey also found that three per cent of the respondents used ‘other platforms’ which CCoF urged “warrants further investigation” on whether this meant that they were using global card networks like Visa or Mastercard, “or are there alternative DFS option gaining traction?”

“Exploring these details can provide valuable insights into user preferences and emerging trends in the Fijian DFS landscape. Additionally, it’s important to understand the reasons behind the relatively low usage of internet banking (16 per cent) and SMS banking (4 per cent),” the report stated.

“Is it due to a lack of interoperability, digital literacy, limited internet access, security concerns, or a preference for more user-friendly mobile wallet interfaces? Addressing these potential barriers could unlock the full potential of these platforms and cater to a wider range of user needs.”

Meanwhile, on challenges faced by consumers in relation to DFS, 35 per cent of the respondents expressed their concerns for security issues, 22 per cent reported limited technology access as a barrier which could be attributed to geographical location, affordability, and lack of infrastructure.

Eighteen per cent had digital literacy issues due to limited financial knowledge, unfamiliarity with technology and language barriers while 15 per cent faced continual transaction errors.

“A significant portion (14 per cent) of consumers surveyed expressed concern that specific groups — women, elderly persons, and persons with disabilities — face challenges accessing and using DFS.

“This finding highlights a potential digital divide that could hinder financial inclusion efforts in Fiji.”

The survey report was launched by deputy Prime Minister and Communications Minister Manoa Kamikamica who commended the effort and the work put in by CCoF.

The report is expected to be available on the CCoF website by the end of this week.