THERE will be no increase in rates of personal, corporate and consumption tax, says Deputy Prime Minister and Finance Minister Professor Biman Prasad.

Speaking during the Fiji Institute of Chartered Accountants (FICA) annual congress 2024, he said Government was leaning towards a distribution tax — on both dividends and head office remittances — at a relatively low level, possibly in the range of 5 per cent.

He said they’re looking at increasing departure tax next year in 2025 while bringing import duty back to zero. Prof Prasad also alluded that Government was making good progress on getting Fiji off the European Union tax blacklist.

“We are not planning any changes in rates of personal, corporate or consumption tax, So — relax,” he said.

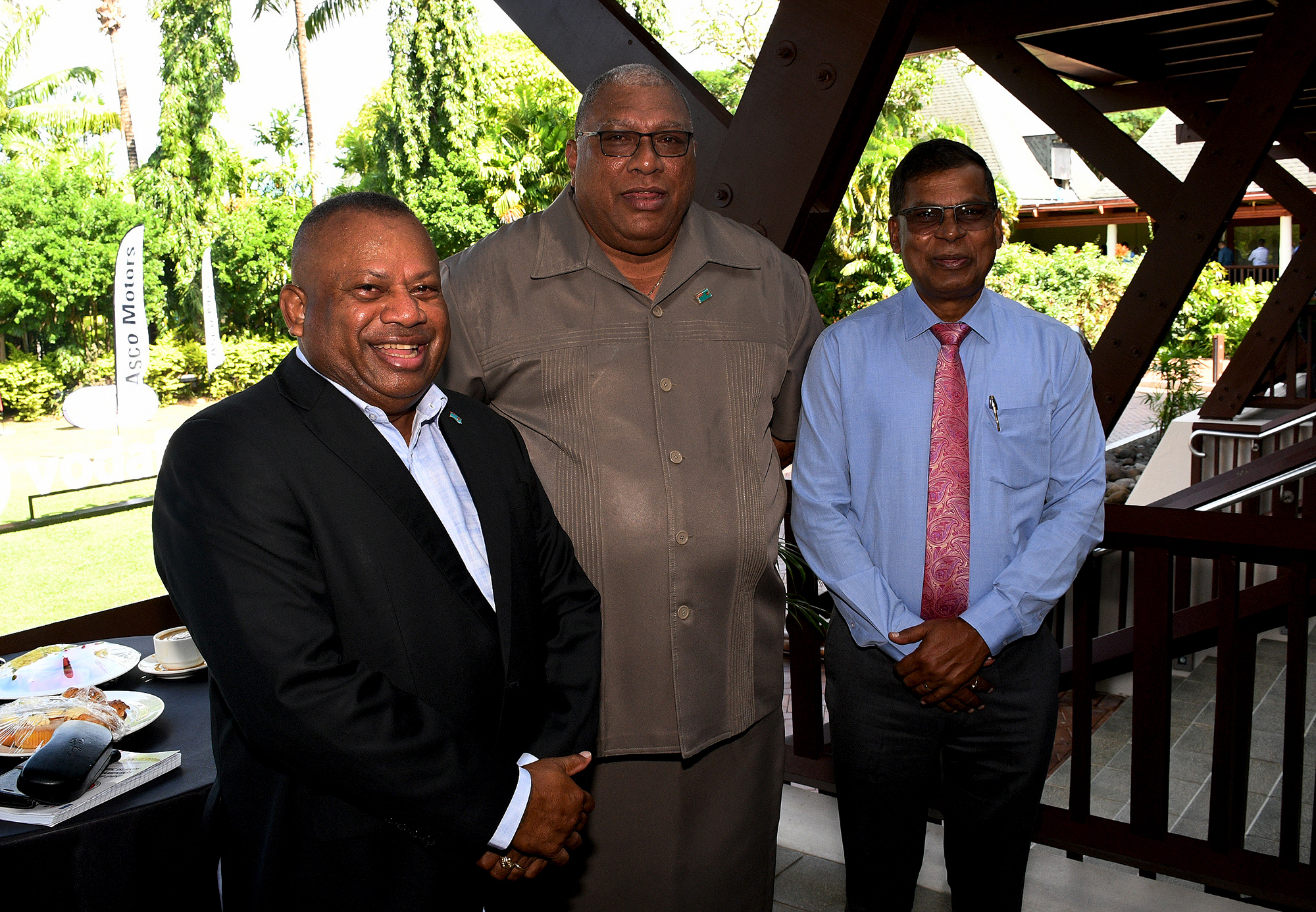

This is the assurance given by deputy Prime Minister and Minister for Finance Professor Biman Prasad while speaking during the first panel session of the Fiji Institute of Chartered Accountants (FICA) annual congress 2024 at the Shangri-La Yanuca Island Resort in Sigatoka.

“That budget was tough for you — we know that. However, as I said last year, our aim is to ensure that our fiscal policies are clearly articulated and consistent and do not change from Budget to Budget,” Prof Prasad said.

“Some people may criticise us for being too open about our policies. After all, if we suggest a distribution tax, will there be a rush of distributions before Budget day? Quite possibly.

“If we say that we are looking at the 3 per cent import duty, will people slow down their importing for two months? Possibly. But I would prefer that we signaled to the business and investing community our intention to be open and transparent, even at the sacrifice of a few tax dollars here or there.”

He said Government was leaning towards a distribution tax on both dividends and head office remittances at a relatively low level — possibly in the range of 5 per cent.

“We are talking to businesses about the merits of this measure and how such a tax could be most effectively implemented. We are also looking at an increase in departure tax in 2025.

“The current recommendations we are considering are to take it from $140 to $170 from April 1, 2025 – however, on the basis that the increment will go towards funding necessary tourism infrastructure, particularly in rural areas where we can harness SME participation and create new tourism experiences. We are still working on this.

“We know that there was a negative response to the 3 per cent import duty imposed on manufacturers. We are looking closely at the arguments to take this back to zero. We will keep you informed on this.”

Prof Prasad said there were other measures that Government was looking at, which includes critical improvements to the Fiji Revenue and Customs Services (FRCS) Taxpayer Online System (TPOS).

“We have heard time and again from business and business advisers on their frustrations with this. And so I say — we hear you. We will fund the necessary work to fix it. We understand the need for business to be able to pay their taxes easily and flexibly.

“That is the least we can do if we ask you to pay taxes. We will also be working on other possible improvements in tax compliance. It seems clear to me that the earlier FRCS staff cutbacks were too much and we need to get more experienced people back into FRCS.”

Prof Prasad also alluded that Government was making good progress on getting Fiji off the European Union tax blacklist and that priority was being given to it.