IT’S the cost of producing gold from Fiji’s oldest operating gold mine that will finally determine whether the majority Chinese-owned Vatukoula Gold Mines Pte Ltd (VGML), which runs the mine, will export gold concentrates or gold dore, the more refined form of the concentrate.

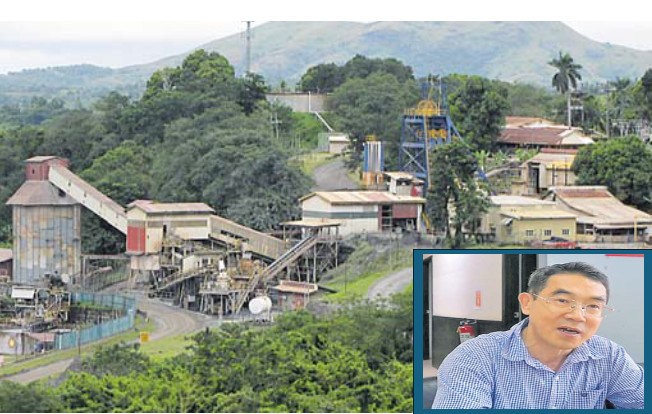

These are the two final products produced at the mine, said VGML vice chairman Ian He in an interview with this newspaper last week.

Right now, their production economics is in favour of gold concentrates, hence, the 40 cargo containers in Lautoka filled with 800 tonnes of gold concentrates waiting to be exported.

At the time of interview, the company was in the throes of accusations by politicians on social media of a litany of shady activities, among them gold smuggling.

VGML’s agreement to our interview request had predated the event, so the timing was perfect to hear from the proverbial horse’s mouth.

“Currently, the international market is very favourable for exporting the concentrate because smelters are competing for concentrates so smelter charges have dropped and there is an increase in the payable prices.

“But this is a time window and this window may not open for a long time so we have to sign contracts to export it.

“If we delay, we miss the opportunity then we’ll have to process ourselves,” Mr He told us.

Nothing is cast in stone in this business.

Things are at the mercy of global commodity prices, such as the world gold price right now, which is around $US2800 ($F6562) an ounce and hovering at historical highs.

Gold set a new record high on February 20 when it peaked at $US2954 ($F6923) an ounce, according to gold market trading data.

While these are price fluctuations based on pure gold and not the forms that are produced at Vatukoula, they affect supply chain dynamics and ultimately, profitability at the mine.

In fact, for the company, shipping its gold concentrates directly to smelters in China has suddenly become a cheaper option than processing it at its own smelter in Vatukoula, which Mr He said is too old and technologically “backwards”.

“It cannot operate in a steady state and one of the reasons for that is because this smelter was designed to handle 60 tonnes of concentrates a day.

“We only produce 20 tonnes a day, so we don’t have enough material to process but for the smelter, once you start up, you cannot shut down frequently.

“You have to keep it running. The cost of running the smelter doesn’t really vary with the throughput, so if we process 60 tonnes a day, the cost of running the smelter is the same as running it at 20 tonnes. So that is why our unit cost has tripled.

“For us currently, our smelting unit cost is $US500 ($F1171) a tonne if we process locally here, based on the 2024 annual data, the entire one year data.

“But currently, international smelter only charges us $US132 ($F309) per tonne, so big difference.”

Last year, when international smelter cost was higher, the company tried but failed to import gold concentrates from the Solomon Islands to ramp up its supply to match the 60tonnes throughput capacity of its 30-year old smelter, a legacy from previous ownerships.

Solomon Islands’ only operating mine Gold Ridge Mine produces 300 tonnes of gold concentrates a day compared to Vatukoula’s 20 tonnes a day and its proximity also made it the ideal choice.

“If we increase our throughput from 20 tonnes to 60 tonnes, it means our unit cost will be reduced to $US170 ($F398). The international cost (smelter) last year was $US250 ($F585) per tonne.

“So if we run at full capacity, and our cost is competitive with international smelters, then international smelter cost is $US250 last year and our cost is $US170, then it made sense to process locally last year, so, no problem with that,” he said.

“So we said, ok, the time window is short. We got the permit to import from the Ministry of Lands and MRD but the Ministry of Finance was too slow that when we finally got the approval from them, the concentrates was sold to someone else.

“So we keep losing business opportunities because the approval process is so slow,” Mr He said.

That window of importing gold concentrates to feed its aging smelter at Vatukoula and produce the gold dore that it exports Australian refineries, quickly closed.

International smelter charges have since dropped, particularly in China, the export destination for Vatukoula’ gold concentrates.

The window of opportunity now open is for VGML to ship its gold concentrates plus any other it is able to get its hands on, directly to China.

But to strike while the iron’s hot is hampered largely by its production output, a mere 20 tonnes of gold concentrates per 1000 tonne of gold ore it mines in a day, and slow import permit processing when trying to source from Solomon Islands.

Never mind the duty on importing concentrates, which, according to Mr He is 15 percent on imports and three per cent on exports.

“We had actually presented a model to our union last year to show that if we smelter ourselves, it would cost us $US500 ($F1171),” he said.

This process produces the gold dore bars, which is a purer form of the gold concentrate, containing roughly 51 percent gold, 39 percent silver and 10per cent impurities, according to Mr He.

VGML exports its gold dore bars to Australian refineries.

“We won’t incur much shipping costs because gold dore is light in weight as we’re talking about kilos, not tonnes,” Mr He said.

“But the smelting cost is so high that it more than offset (the benefits from the shipping cost). The shipping cost for us is only $US204 ($F478) a tonne. And this (modelling) was done last year where the major component of the $US204 was insurance.

“Now, shipping insurance is down substantially so our shipping costs will be lower, not more than $US200 ($F468) a tonne.

“And China does not impose any import duty for their smelters, so when smelters in China import concentrates, the Government will not impose import duty, so then, it’s economical.

“But China may apply import duty on imported concentrates and if it does, then the economic condition would have again switched and then we’ll have to come back to exporting dore.

“Also, currently, world gold price has gone up substantially and the higher the value, the more economical for long distance shipping.

“Last year, when the gold price was $US1900, it was not economical to ship the gold concentrate.

“But now it’s $US2900, so it has become economical because the shipping cost hasn’t changed while the commodity price has increased.

“So these are the economic situation changes and we really have to monitor those economic factors and we keep updating the input data so that we understand when to sell the concentrate and when to sell the dore,” Mr He said.