FIJI’S economic growth has been revised downward with the local economy now expected to grow by 3.2 per cent this year, marginally lower than the 3.4 per cent forecast earlier.

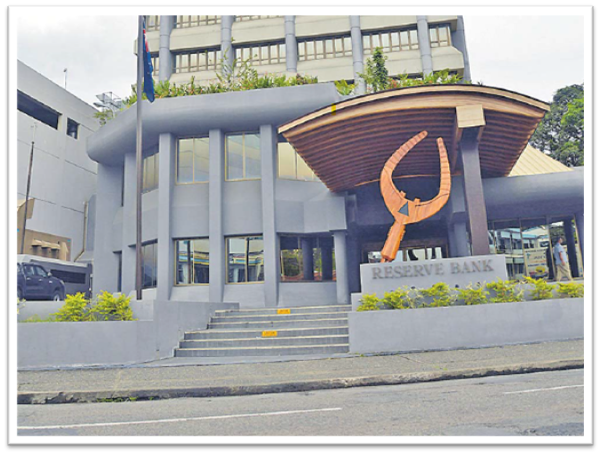

The Reserve Bank of Fiji’s (RBF) Macroeconomic Committee announced this Wednesday after conducting a robust assessment of the economy – amid challenges of ongoing trade wars, geopolitical tensions, downward revisions of Fiji’s trading partners’ growth outlook, and varying speeds at which some central banks have reacted.

Committee chairman and RBF governor Ariff Ali said partial indicators such as domestic VAT collections, wage and salary, employment, remittances and bank credit showed notable growth and supported the revised economic projection.

“For 2026 and 2027, growth is expected to be broad-based and return to its long-term trend of around 3.0 per cent,” Mr Ali said, adding the service sectors remained the main contributor to growth, followed by industrial and primary sectors.

Domestically, data for the five months had been generally positive, except for visitor arrivals that was initially assessed to rise by 4.0 per cent this year following record arrivals last year.

However, based on recent trend and industry feedback, he said 2025 visitor arrivals were now forecast to be flat.

“On the upside, Government expenditure has boosted demand, and expectations are the upcoming national budget will remain supportive of growth.

“Consumption remains strong while accommodative monetary policy is supportive of investment activity.”

ANZ Group Senior Economist Pacific Dr Kishti Sen said they had predicted Fiji’s economy would likely grow by 2.8 per cent this year.

He said a loss of momentum for Fiji was inevitable after the “remarkable” success of its post-pandemic recovery.

“As ever, consumer demand holds the key to Fiji’s baseline economic performance; and the key to private consumption expenditure is household disposable income,” Mr Sen told The Fiji Times yesterday.

“For the formal economy, consumer spending power is supported by recent wage increases although jobs growth has been soft – strength in construction employment offset somewhat by weak accommodation and food services employment due to challenges in inbound tourism demand.”

He said for informal or rural households, the security of remittances and farm income supported spending.

“While not extraordinary, consumer demand will put a floor under Fiji’s GDP and we think it will contribute at least 1.5 percentage points to overall growth in 2025.

“Then, when you add the contribution from public demand, both recurrent and investment spending and private investment, you see the economy pushing towards 3 per cent growth this year.”

Mr Sen said key for Fiji to grow its economy was to put more cash into smallholder farmers by upscaling agriculture production volumes, diversifying commodity exports, and improving market access.

“The other is to expand its formal sector employment by moving private sector projects to commencements with some urgency.”

Meanwhile, the Committee also reviewed the 2024 growth rate, now estimated to have expanded by 4.0 per cent.

“The key drivers of economic growth were the public administration, transport & storage, accommodation, ICT, wholesale & retail trade, financial services, manufacturing and agriculture sectors.”

The committee will review these projections in the last quarter of 2025.

Note: This article was first published on the print version of the Fiji Times dated June 13, 2025