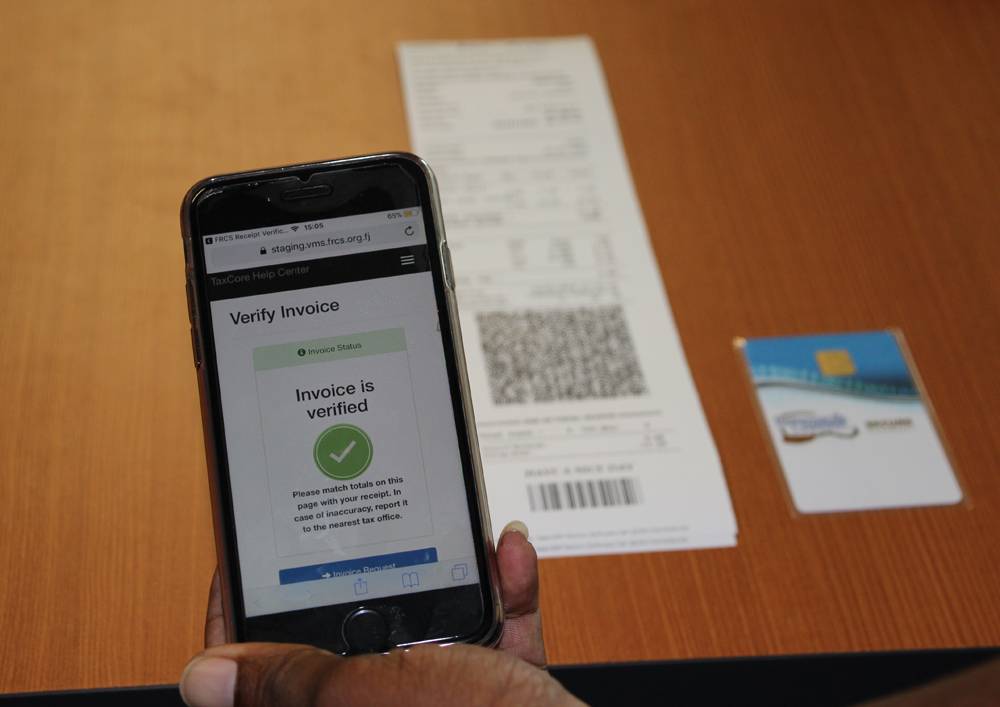

Value Added Tax (VAT) Monitoring System (VMS) will come into effect for supermarkets, pharmacies, accounting firms, medical centres, travel agencies, law firms and hardware companies from December 31, the Fiji Revenue and Customs Service has announced.

FRCS states this was announced in the 2024-2025 national budget, effective from 1stAugust 2024, the VAT Monitoring System (VMS) has been re-activated.

‘Therefore, FRCS would like to advise all businesses that were gazetted under Phase 1 and 2 of the VMS rollouts that they need to be fully compliant by 31st December 2024,” states FRCS Chief Executive Officer, Udit Singh.

FRCS had undertaken physical verifications and has ascertained that several

businesses are non-compliant.

“All businesses that fall under the above categories but are yet to implement /activate VMS must install, implement and operate an Electronic Fiscal Device (EFD) (of which each POS (Point of Sale) and E-SDC (Electronic Fiscal Signature Device) are accredited) by

31st December 2024.”