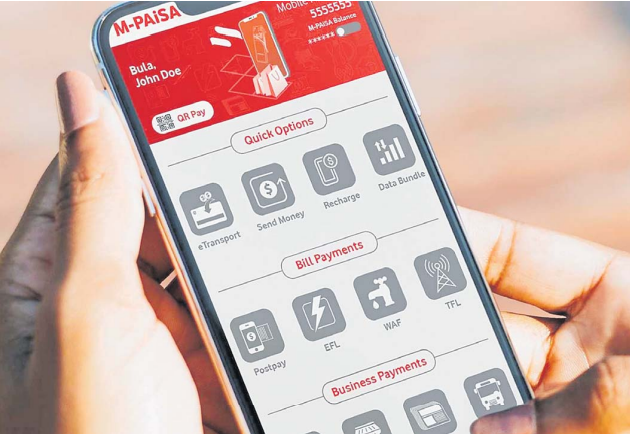

WHEN money moves with a single tap, a small mistake can carry big consequences. For many of us, e-wallet services such as Vodafone’s M-PAiSA platform have become a lifeline — the fastest way to send money to loved ones, pay a taxidriver, or settle bills.

But as the number of transactions grows, so too have cases of money being accidentally sent to the wrong number — and the public frustration that follows when those funds cannot be quickly reversed. In my case, it happened twice, two wrong numbers and two accidental MPAiSA transfers that set off days of frustration. Like many Fijians who rely on mobile money, ‘

I discovered that sending funds to the wrong number is easier than you’d think and getting them back was not. I took to social media to air my frustration, and to my surprise, I was not alone.

The comments and feedback I received revealed just how common this issue is — many Fijians are still waiting for money they accidentally transferred to the wrong number to be returned to their account. Vodafone manager M- PAiSA Shailendra Prasad says while customers may expect an instant rollback, the company’s hands were often tied by fairness and the law.

“The disputed money is not the property of M-PAi- SA and neither is it entitled to it at any point in time,” Mr Prasad said. “We act in the interest of both parties, in fairness.” He said M-PAiSA’s responsibility is to protect all users — both the sender and the unintended recipient — without assuming who is right or wrong. “Once money leaves the sender’s account and goes to the recipient account, we cannot, without the account holder’s consent, act unilaterally to deduct any funds from their account.”

A digital dilemma The problem, Mr Prasad said, began with human error. “Unfortunately, one of the common mistakes senders make when transferring money from M-PAiSA or from banks to M-PAiSA is entering the wrong account number.

“This happens in two ways, either a completely different number to the intended recipient number is entered, or a transpositional error where account numbers are mixed up with digits entered in the wrong order. “Example, instead of entering 2173649, 2713649 is entered, resulting in money being sent to the wrong person.”

Once a transaction is confirmed, the money leaves the sender’s account immediately, and from that point, M-PAiSA or Vodafone no longer has control. “There is no way for M- PAiSA to ascertain if the money sent to a number is legitimate or a mistake. We cannot simply take the word of the sender. “This is the explanation, if M-PAISA were to roll back the funds to the sender when it happens to be a genuine payment made to a recipient for some service they provided for which they were entitled to, then it would undermine the right of the recipient.”

This is what he calls the “M-PAiSA dilemma. “It could also result in users losing their trust and faith in the service as a reliable payment service.” Mr Prasad gave an example, “if you were to use a taxi and told the driver that you would pay by M- PAiSA, you would transfer the money to the driver’s MPAISA number.

However, as soon as you get out of the taxi, you call M-PAiSA and claim to have sent money by mistake to the taxidriver’s number and ask if M-PAiSA could roll back the funds. This would undermine the right of the taxidriver, and also M-PAi- SA has no right to deduct funds from the taxidriver’s account without his/ her approval”.

Case-by-case approach Mr Prasad explained that when M-PAiSA receives a dispute (ie, details on the transaction that was sent to the wrong number), the first step is to check whether the recipient has already accessed the funds. “In such a scenario, as long as the money has still not been uplifted by the recipient, the funds are placed on hold. M-PAiSA calls the recipient to verify if they have received it by mistake from someone, and if the funds could be rolled back to the sender.

“If the recipient agrees, funds are rolled back; if he says ‘no, that is the money I am entitled to’, then we ask the sender to either contact the recipient directly to reimburse or to take the matter through the legal process to ascertain who is the rightful owner of the amount sent.”

He admitted that this could be a “lengthy and frustrating process,” but says it was the only approach consistent with fairness and the law. “It is important as a service provider that we maintain neutrality and the rights of both parties in a disputed transaction and let the law decide.” ‘

Reducing mistakes before they happen To reduce the number of accidental transfers, M- PAiSA introduced a doubleentry confirmation system. “M-PAiSA A quires the recipi- ent number to be entered twice as a means to validate and confirm the re- number to minimise errors such as ing the digits its in the wrong order.” Even so, he stresses that technology can only do so much. enter- “The onus is still on the sender to be sure that the number they are entering in the first place is the correct number of the intended recipient to whom money is being sent. “This is not something within M-PAiSA’s control.”

Mr Prasad said Vodafone has continued to use public awareness campaigns to educate customers. “We continue to highlight and advise M-PAiSA users to always check and reverify the account number of the person they are sending money to before they press the send button.” Fairness over speed Behind the scenes, the company’s guiding principle is balance — ensuring that neither party is unfairly treated.

“As much as M-PAiSA provides a quick, easy, and convenient option to send money to one another, sometimes users overlook the need to verify and reconfirm recipient details, such as account number/ mobile number, and amount before sending money.”

Mr Prasad said many customers expect an “instant rollback,” but M-PAiSA operates under mobile money regulations and must comply with regulatory requirements. Once money is received in another person’s account, the ownership of funds changes. Without the account holder’s consent or a court order declaring who has the rights to the funds, M-PAiSA declares it a disputed transaction and must follow the legal process. For now, the message is simple: prevention is better than cure.

Doublecheck before you hit send.