IN a first for Fiji, dual listing of companies that wish to go public will soon be an option made available on the South Pacific Stock Exchange (SPX). In a statement released yesterday, SPX announced the formal establishment of a high-level industry working group to develop a framework that will enable companies to list and trade shares on both SPX and Papua New Guinea’s National Stock Exchange (PNGX).

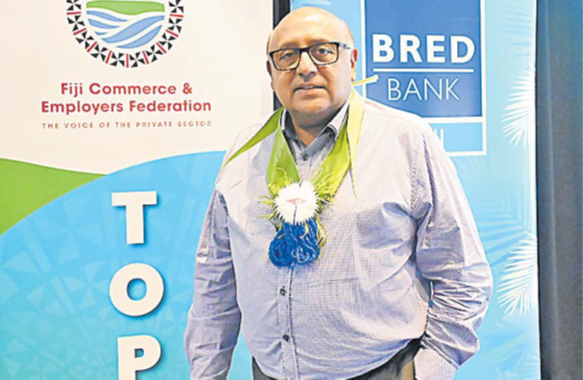

SPX chairman Nitin Gandhi, who also chairs the working group, said the move was a meaningful step toward regionalising capital markets in the Pacific. “To deliver a dual listing framework that truly works for Fiji, we need a cohesive effort and multi-stakeholder engagement at every level including legal, regulatory and operational. The working group provides a platform for this collaboration and reflects our shared commitment to building a practical and forward-looking cross-border market structure.”

The working group, which held its first meeting last week, comprises representatives from SPX, the Reserve Bank of Fiji, PNGX, the Ministry of Finance, Strategic Planning, National Planning & Development, the Registrar of Companies Office at the Ministry of Justice, Investment Fiji, Fiji Revenue and Customs Service and selected market participants including stockbroker firms, investment advisory firms and representatives of the private sector.

According to SPX, the working group is mandated to address legal, regulatory, tax and operational matters necessary to make dual listings a reality. “This includes designing mechanisms for share transferability between Fiji and PNG, developing coordinated regulatory oversight arrangements and potentially recommending a pilot transaction to validate the framework in practice,” it stated.