Despite Fiji’s inclusion in Pacific Catastrophe Risk Insurance Company’s (PCRIC) risk pool, the country currently lacks a PCRIC insurance policy.

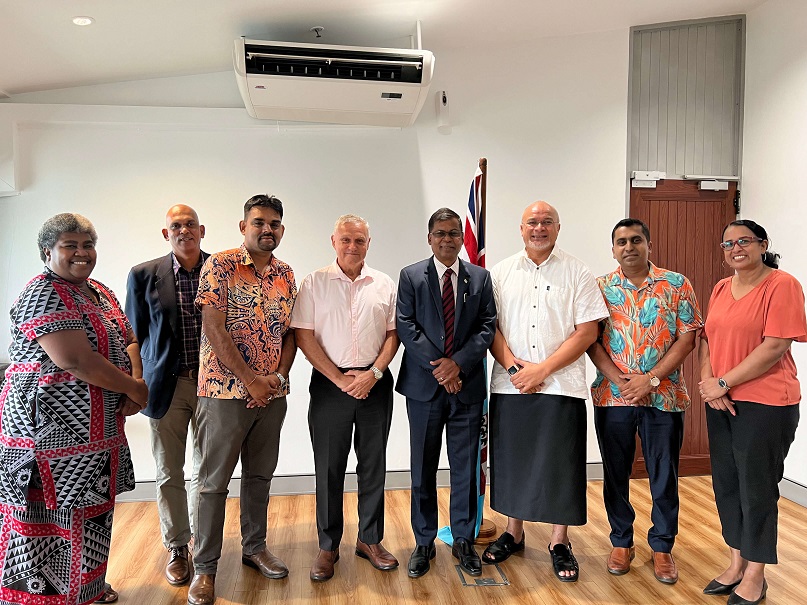

This was highlighted by PCRIC during a meeting with Deputy Prime Minister and Minister for Finance, Strategic Planning, National Development and Statistics, Professor Biman Prasad.

A media release from PCRIC said its previous engagements with the preceding government were favourable and culminated in the signature of a letter of commitment by the permanent secretary towards the end of last year, indicating a commitment to purchase a tropical cyclone policy that would be effective from October 1, 2023.

It said discussions aimed to solicit the support of the new administration in light of PCRIC’s disaster risk financing instruments designed to bridge Fiji’s financial vulnerabilities in the face of disasters and enhance their resilience against the loss and damages resulting from natural hazards.

Meanwhile during the meeting Prof Prasad acknowledged PCRIC’s services to the region and highlighted that as part of the new coalition government’s policies, regional cooperation and unity is important.

“The products being offered by PCRIC are innovative and very welcome. I hope that the region as a whole will see value in these cutting-edge parametric insurance products. I’m optimistic that Fiji will play its part in ensuring that we are part of any groundbreaking solutions to disaster risk financing as it is a significant challenge for us all,” he said.

Prof Prasad said the impact of disasters on Pacific Island countries caused a great deal of damage to development and had an immense negative impact on the quality of life on our people.

“Therefore, any means to address those fundamental impediments would be cordially received.”

PCRIC chief executive officer Aholotu Palu said with the fiscal constriants that countries were facing, it was only appropriate that countries access and diversify its disaster risk finance tools to maximise financial returns to support their resilience building efforts and climate change adaptability approaches.

“We recognise that the COVID pandemic has seriously affected countries’ fiscal affairs, and PCRIC diligently seeks to secure donor resource funding for premium subsidisation when engaging in dialogue with countries in purchasing a policy.

“Though PCRIC has received $10 million in premium financing from Germany via the World Bank as a Christmas gift in 2021, these vitally necessary donor support funds are still with the World Bank,” he said.

The PCRIC team was led by one of its directors Barry Whiteside while Prof Prasad was accompanied by Shiri Gounder, permanent secretary of the Fiji Ministry of Finance, and former chairman of the Pacific Catastrophe Risk Insurance Foundation Council of members.