Papua New Guinea had a record year for cocoa exports in 2024. It yielded PGK1,233m in export revenue, surpassing coffee receipts of PGK989m for the first time in PNG’s history.

That higher ranking will, in our view, be short lived. While prices are expected to stay high, PNG cannot significantly increase supply quickly due to historically small crop sizes.

Coffee, on the other hand, is expected to have another bumper year following a low volume season last year. Coffee yields alternate between low- and high-volume seasons.

Coffee prices have also risen sharply recently, following news that Brazil’s crop will be impacted by unfavourable weather. Record coffee prices and higher export volumes are likely to see PNG’s coffee reclaim its top spot in its arm-wrestle with cocoa.

For 2025, we forecast PGK1580m of export revenue for coffee versus PGK,363m for cocoa, yielding a combined revenue of PGK3,000m and surpassing last year’s record of PGK2222m.

Neck and neck price rally in cocoa and coffee

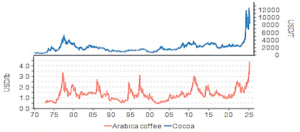

Global cocoa crop production declined by 13.1 percent to 4.3mt in the 2024 calendar year, after drought and disease decimated yield volumes in Ghana and Cote d’Ivoire.

With end-use demand holding, prices shot up to an average of USD8214/t, a rise of 148.2 per cent over 2023.

Coming into 2025, news of weak volumes again from both countries saw prices rally. In January, cocoa prices averaged USD11,159/t, up 150.4 percent y/y. However, recent rains in West Africa have raised hopes for a better mid-crop (harvested over April to September).

This, together with some moderation in demand in Europe, resulted in prices retreating a little in February to average USD9917/t.

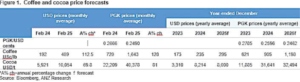

Overall, we expect the cocoa crop shortage will linger for another year at least, so we believe the market will remain tight this year, with prices to average an even USD8,000/t

(Figure 1) Coffee and cocoa price forecasts

Coffee production joined the slump in the second half of 2024, after Brazil announced downgrades to its Arabica beans production due to the impact of La Niña rains on coffee tree flowering.

Brazil accounts for 40 percent of global coffee bean production. The crop damage will lower yield volumes from Brazil’s next harvest, starting in April (2025-26 season). This has seen an unprecedented lift in coffee prices to a peak of USD4.39/lb on 13 February

(Figure 2) Cocoa and coffee (Arabica) prices since 1970

Overall, coffee demand is still strong, so we believe coffee prices will stay high in 2024 and average USD2.95/lb, the highest annual average ever.

Strong coffee market puts 1m bags of coffee exports on the radar

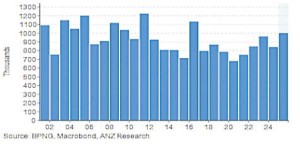

PNG exported 827,100 bags of coffee in 2024, 14.1 percent less than in 2023. However, in coffee years (measured from May to April), coffee volumes for the first eight months of the 2024-25 season are well down on the same period of the previous season (564,214 bags versus 768,325 bags, a fall of 26.6 percent). That is understandable, as a bumper crop is usually followed by a low-volume season.

And the 2023-24 season was a good crop year for PNG, with 1,031,211 bags exported between May 2023 and April of 2024. Given that the 2024-25 season, which concludes in April, is a low-volume year, the next season (which commences in May) is likely to be a high yield year.

Export volumes are expected to consistently hit more than 100,000 bags every month from August onwards.

(Figure 3) Bags of coffee exports, PNG

The other positive for coffee exports this year is the price. Record prices will make it more worthwhile for farmers, especially those in remote areas, to bring their coffee cherries to the market/buyers.

So, we think PNG can achieve a million bags of coffee exports in calendar year 2025, despite the overhang of a low-volume crop for the first four months of this calendar year.

The risk is that the steep increase in prices means middlemen, aggregators, millers and traders need extra cash to purchase the cherries, parchment and green beans. This may catch some participants in the coffee supply chain off-guard with respect to securing their working capital budgets when the coffee flow picks up from May onwards.

Resilient cocoa market means cocoa export volumes will rise

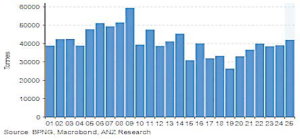

Skyrocketing cocoa prices helped PNG export more cocoa beans last year. In total, PNG exported about 39,000t of cocoa in calendar year 2023 an increase of 1.3 percent y/y.

The unprecedented ‘Everest like’ price jumps in 2024 should have stimulated higher export volumes, especially given that PNG has exported up to 45,000t as recently as 2014 and 60,000t in 2009 before cocoa pod borer disease reduced crop sizes in East New Britain.

The problem for PNG is that in recent years a significant number of farmers switched from cocoa to balsa wood plantations due to lower cocoa prices, and new cocoa tree plantings haven’t offset trees lost to balsa. So, despite record prices last year there was limited upside to the tonnage of cocoa beans produced and exported.

That said, the record prices will have funded small-holder farmers to apply fertiliser and intensify care of their crops, increasing yields. Based on this, we believe PNG can export 42,000t of cocoa this year

(Figure 4) Tonnes of cocoa exports, PNG

Coffee gets its mojo back in terms of export receipts

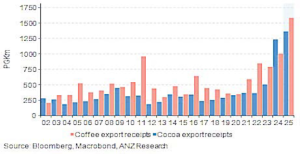

Historically, PNG’s coffee has outmuscled cocoa, in terms of export receipts. However, cocoa turned the tables last year, generating PGK1,200m versus PGK989m for coffee

(Figure 5) Coffee and cocoa export receipts, PNG

For 2025, coffee is predicted to regain its front runner position, with PGK1580m of export revenue forecast compared to PGK1363m for cocoa. Higher export volumes and a steep lift in prices will tilt the balance in coffee’s favour.

Global pricing

PNG is a ‘price taker’ in international commodity markets, and its coffee and cocoa exports are no different. Despite a global crop shortage, PNG has to accept and sell at global market prices, which are subject to the whims of supply and demand balances. In calculating PNG’s export receipts for coffee and cocoa, we used global prices.

PNG sells its A- and B-grade coffee at a premium, but we have made some adjustments to these price differentials, as selling into an already hot market with a positive differential would be difficult.

For PNG to remain competitive some of the differentials will have to give, and exporters will need to sell close to the world price for coffee, in our view.

A domestic price that is not consistent with global prices risks PNG becoming uncompetitive and puts it at risk of having difficulty offloading beans in the international market.

Rakiraki. Picture: DIONISIA TABUREGUCI

- KISHTI SEN and TOM KENNY are senior international economists, and SONI KUMARI is a commodity strategist with ANZ Group. The views expressed are not necessarily those of The Fiji Times.

NOTE: This article was first published in the print edition of the Fiji Times dated MARCH 14, 2025.