Gone were the days when $20 could fill a supermarket trolley. Beer drinkers and cigarette smokers had to pay more.

Smokers had to fork out two cents more for a packet of 10s and four cents more for a packet of 20 cigarettes.

A packet of cigarettes cost between 48 and 50 cents, and 20s cost between 96 cents and a dollar.

These statements were captured in an article in The Fiji Times on September 5, 1984, detailing the 1985 budget report.

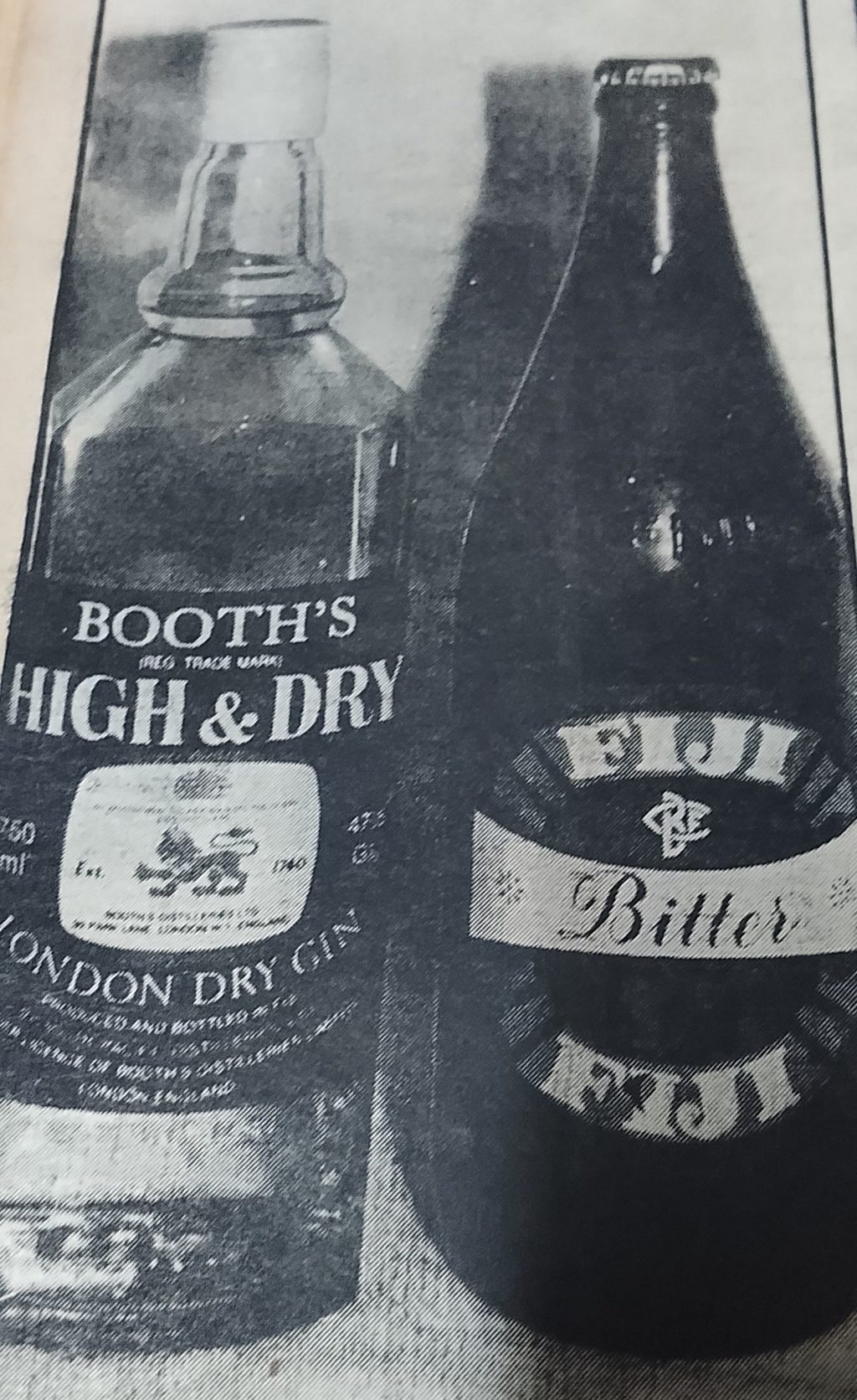

Beer drinkers, who, until the day before, paid $9.90 a carton of 12 bottles, had to pay 75 cents more. A bottle cost 92 cents in supermarkets and retail outlets.

The price of liquor spirits rose from $11.60 per bottle to $12.10. The bigger bottle (40 ounces) cost 75 cents more.

But those with a taste for overseas liquor had to pay up to $30 for a bottle. A large “40 ounce” bottle of imported spirits cost up to $45, depending on the brand and maturity of the liquor.

A 200-gram packet of locally-made detergent that used to cost 49 cents increased to 54 cents.

Packets of four toilet rolls costing between 99 cents and $1.04 cost 20 cents more while soft drinks cost about 20 cents more for a carton of 12. They used to sell for about $4.70 per carton.

Edible oils, including vegetable ghee, cost a cent more per bottle. Salad oil used to sell for $1.35 while vanaspati was $1.27 per bottle. A 500-gram packet of margarine would now cost a cent more.

Duty ranging from 35 per cent to 55 per cent was imposed on imported consumer goods.

Duty went up on local cigarettes, tobacco and beer, local spirits, meths, aerated water, soap and detergents, snack foods, cement, toilet paper, sugar, paints and enamels, edible oils (about 1 cent per 750mm) margarine (1 per cent per 500mm), foam and sponge materials, serviettes, tissues, paper plates, washers, screws, nails, tacks and staples; galvanised roofing iron, plastic roofing, guttering, rope, cord and twine.

Duty on petrol increased to 22 cents per litre, an increase of about 4 cents over the then price of 59 cents per litre. Diesel fuel cost 4 cents more, about 48 cents per litre.

Duty on vehicles amounted to another 30 per cent for motor caravans, 15 per cent for other passenger vehicles exceeding two tonnes gross unladen weight.

To help the duty-free trade, duty was decreased to 10 per cent for video decks, hair dryers and curlers, microphones, amplifiers and speakers, radio receivers, hi-fi sets and other sound recorders and reproducers.

Extra duty put up the prices of these imports by about 35 per cent to 72.5 per cent — fresh, chilled and frozen fish, crustaceans and molluscs, retail packet butter, jams, fruits and jellies, tooth paste, cosmetics and toilet preparations, soap and detergents, suitcase attaché cases and plastic beauty cases; paper plates, mats, ready-made garments, barbed wire, paper board, louvre blades, window frames, nails, tacks and staples, blank video and audio tapes, collectors paintings drawing and antiques and antique furniture.