The Fiji Revenue and Customs Service (FRCS) has clarified that the requirement for individuals and businesses to hold a valid Taxpayer Identification Number (TIN) when opening or maintaining Mobile Wallet (e-wallet) accounts does not introduce any new or additional taxes.

In a statement addressing misinformation circulating on social media, FRCS stressed that the measure is purely administrative.

“The TIN requirement is an administrative measure designed to strengthen risk assessment and compliance processes, improve financial transparency, and support national efforts to ensure a fair, efficient, and modern tax administration system in Fiji,” FRCS said.

The revenue authority emphasised that the requirement does not alter existing tax obligations and is not intended to increase the tax burden on individuals or businesses.

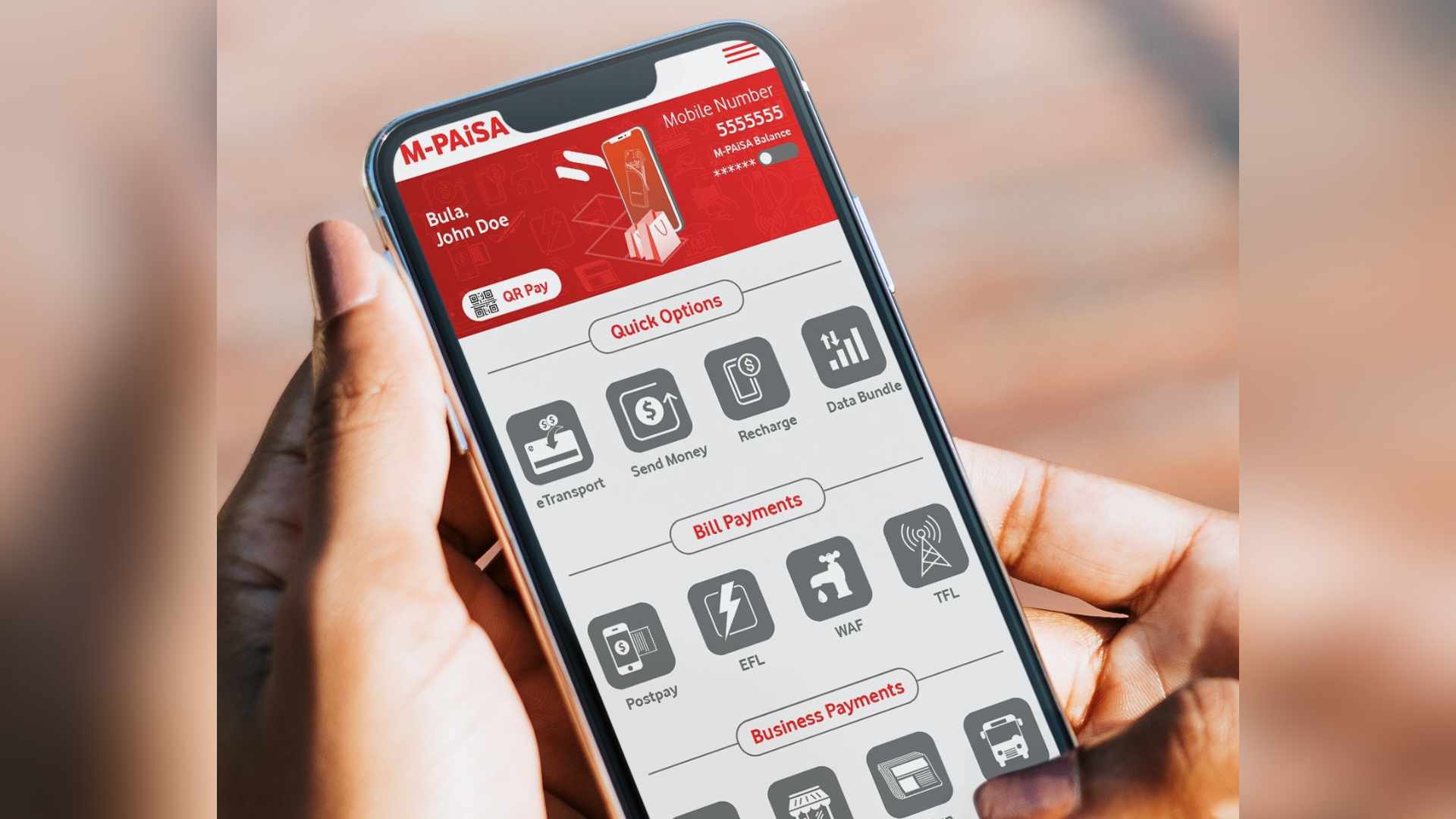

FRCS said that, in line with the 2025–2026 National Budget Promulgation, all individuals and businesses must obtain a valid TIN if they do not already have one, and update their registration details with their respective licensed e-wallet service providers by 31 December 2025.

“FRCS is working closely with licensed e-wallet service providers to facilitate a smooth and orderly implementation of this requirement,” the statement said.

The authority also thanked taxpayers for their cooperation as Fiji continues to strengthen its financial integrity and regulatory framework.

“Members of the public are urged not to rely on unverified social media speculation and to seek official guidance directly from FRCS,” the statement added.