Cashless transactions must be properly taxed to curb the shadow economy.

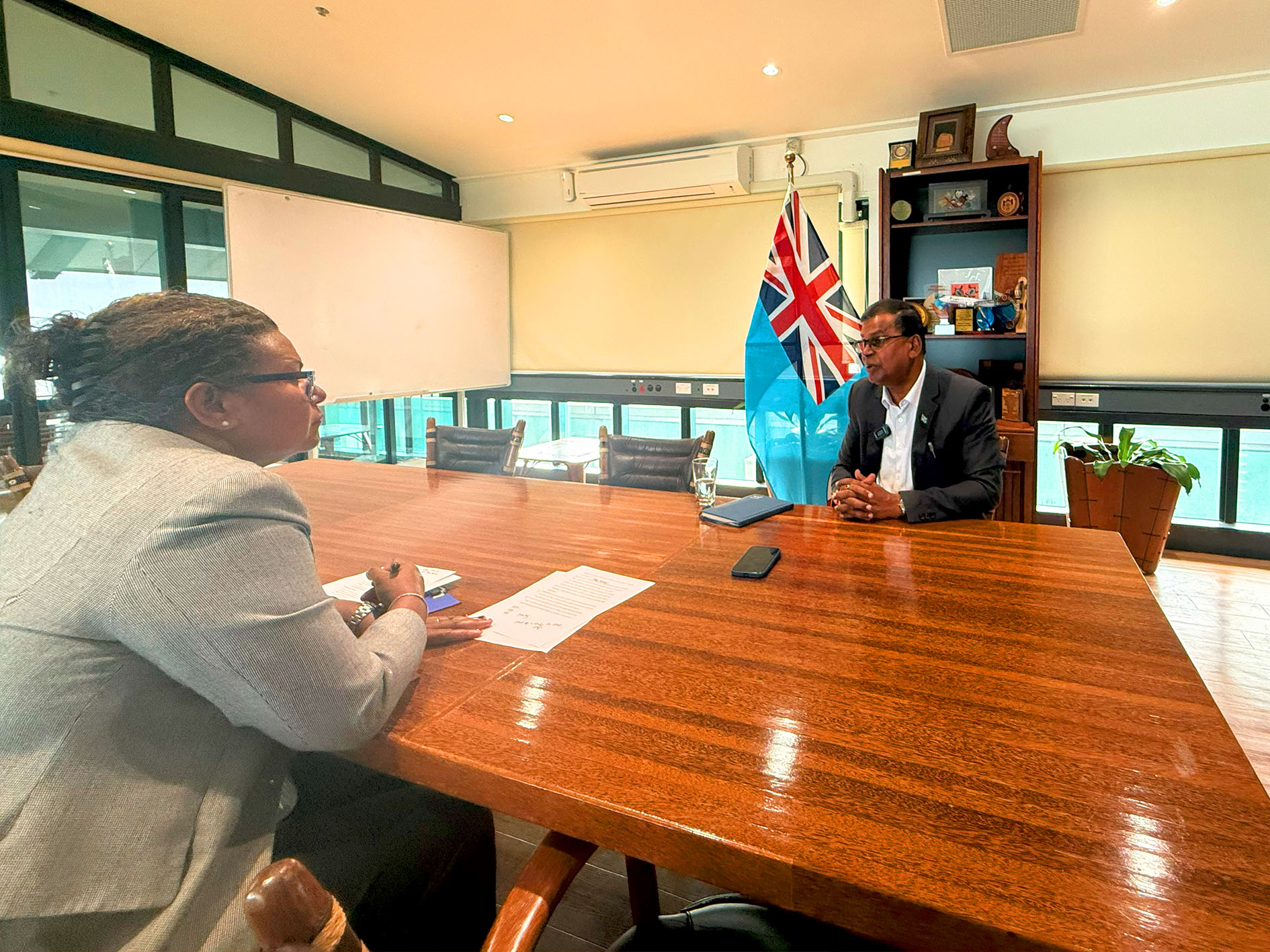

In an interview on The Lens @177, Acting Prime Minister and Minister for Finance Prof Biman Prasad said that from the last budget “anybody who wants MPAiSA… will have to have a tin number.”

Prof Prasad said too many businesses had been taking payments through personal numbers to avoid recording sales and paying tax.

“They’ve got the money, they’ve sold the item, it’s not recorded… we don’t get any tax, they don’t pay any tax,” he said.

The change is part of a wider Fiji Revenue and Customs Service tax compliance strategy, launched recently to go after illicit activity.

He said the new asset-declaration requirement in the Tax Administration Act would also shine a light on unexplained wealth.

“If you’re declaring $100,000 income, and you’ve got two houses, or four cars, where did you get that money?” he said.

The minister said these steps are “first time” measures to close loopholes and bring more activity into the tax net.

He also linked them to the fight against narcotics and the shadow economy.

“We are putting in appropriate policies… we’ve got support from the Australian government for container X-rays… all items that come in… will now be X-rayed,” he said.

MPAiSA users are required to present a valid ID such as a voter registration card, FRCS/FNPF card, or birth certificate with photo ID when registering or updating their profile.

Failure to comply with the identification requirements may lead to restricted ability to use services such as sending or receiving money.