The Fijian Government in the 2020/2021 National Budget has reviewed and reduced the duty rates on the used motor vehicles and machinery imported into the country.

This has allowed Fijians to purchase affordable, quality and safer vehicles.

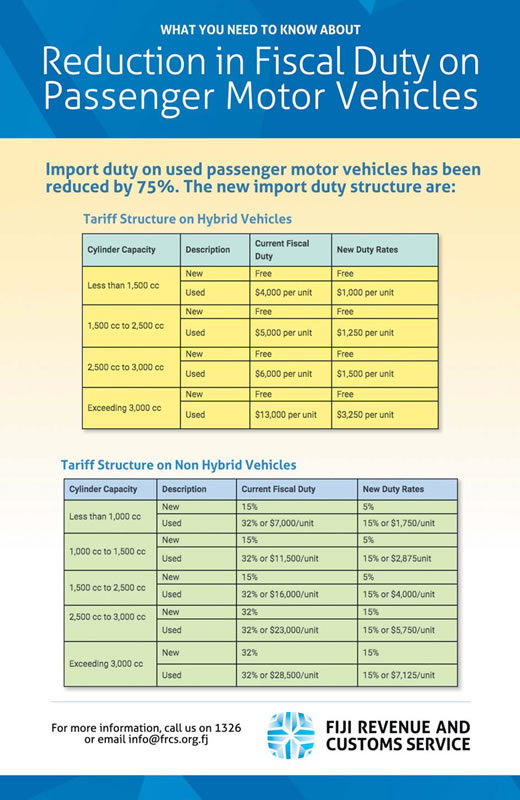

The specific fiscal duty rate on used motor vehicles (hybrid/nonhybrid) has been reduced by 75 per cent whereas the fiscal duty on new motor vehicles (non-hybrid) has been reduced to 5 per cent.

The import excise duty as well as the luxury levy has been removed to allow vehicles to be sold at a lower price.

An Environmental Climate Adaptation levy (ECAL) of 5 per cent is applicable on the importation of all motor vehicles.

Fiscal duty on the importation of all machinery as per Chapter 84, of Schedule 2 of the Customs Tariff Act 1986 has been reduced to free.

The importation of machinery does not require issuance of any import licence from the Fiji Revenue and Customs Service (FRCS), however the importer is advised to consult with other stakeholders such as the Land Transport Authority before importing into Fiji.

FRCS would like to advise all motor vehicle dealers, traders, importers and the general public that the importation of used motor vehicles into Fiji is subject to issuance of an import licence as per Schedule 3 of the Customs (Prohibited Imports and Exports) Regulation 1986.

To be eligible for an import licence, the used motor vehicle must meet the following criteria:

Hybrid

* Five years or less from the year of manufacture; and

* Euro 4 compliant.

Diesel/Petrol/Solar/Electric/ CNG/LPG

* Euro 4 compliant. The minimum year model for a used hybrid that is acceptable for importation in 2021 is 2016 and over.

To obtain an import licence, a written application has to be made to the chief executive officer-FRCS with the relevant documents of the motor vehicles such as:

* the export certificate or deregistration documents

* applicant’s identification card

* Japan Export Vehicle Inspection Center Co Ltd (JEVIC) report (Australia, New Zealand and Japan Imports)

* Certificate of compliance to Euro 4 standards if JEVIC is not available in the country of export

* Any other document as required for the purpose of import licence

Motor vehicle dealers and personal importers are advised that they can lodge their import licence directly with FRCS and there is no application fee required.

However, please note that in the case of any third party clearance i.e. if the application is unable to submit the application in person, a formal authorisation letter must be attached to the application by the importer of the goods.

The authorised person must have a valid photo ID when obtaining the import licence from FRCS.

Additionally, importation of all written off vehicles are prohibited.

These include statutory, repairable and or any other written off vehicles.

The importation of left hand drive is also prohibited except for diplomats or other importers as approved by the LTA under LTA’s Regulations.

Importers are encouraged to consult LTA before importing any left-hand drive vehicles to Fiji.

If the used motor vehicles do not meet the criteria for importation into Fiji, the following will apply: (i) will not be eligible for issuance of an Import Licence; (ii) will be considered a prohibited import; (iii) will not be permissible for release; (iv) will be subjected to re-exportation at the cost of the importer.

Once the import licence is issued by FRCS, the importer will need to engage the services of a licensed Customs agent to have the motor vehicle duty paid and cleared.

Customs duty on used motor vehicle is based on the cylinder capacity as per the Customs tariff and duty is calculated on a CIF basis (cost, insurance, freight).

The steps on how the duty amount is determined can be found on this link https://www. frcs.org.fj/our-services/calculators/ customs-charges-duties/.

The Customs tariff is available for download from FRCS website: https://www.frcs.org.fj/wpcontent/ uploads/2020/11/Customs- Tariff_2020.pdf FRCS urges all motor vehicle dealers, traders, importers and the public to obtain an import licence before loading and shipping of the vehicles for Fiji to avoid unnecessary inconveniences such as the delay in issuance of import licence, storage charges or in extreme cases re-export cost.

Should you require any further information, please send your queries on info@frcs.org.fj.