LIFE and health insurance provider BSP Life’s investment portfolio is now a little over $1.25 billion, maintaining its position as the second largest institutional investor in the country.

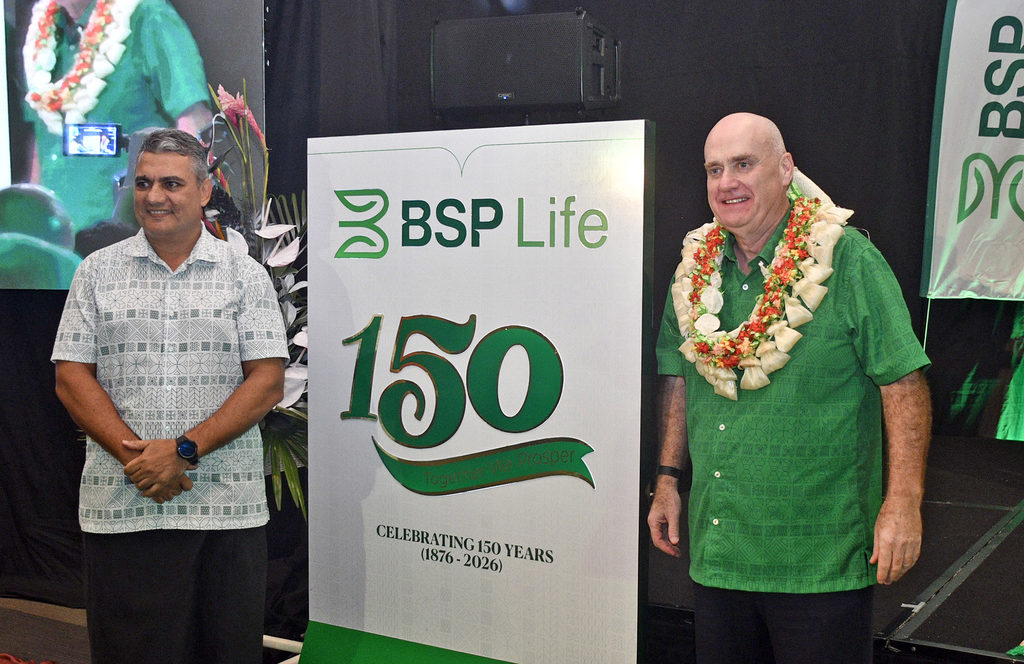

BSP Group chief executive officer Mark Robinson made this announcement at the celebration of its subsidiary company’s 150 years of continued operation in Fiji.

“We’ve gained our position again as the second largest institutional investor and we support projects of national importance,” Mr Robinson said at the event held at the GPH in Suva this week.

He cited the One&Only Resort in Yasawa, a partnership with Kerzner International and the $230 million dollar Vatu Talei joint venture with national airline Fiji Airways as two of their prominent projects.

Mr Robinson said in BSP Life’s board meeting this week, they spent time going through a detailed review of the large investments it had in the country.

“And there’s a tremendous amount of diligence that we apply to them.

“These projects, of course, both benefit the national economy, but as importantly, they provide an example to the world, the world beyond the Pacific about how attractive Fiji is for investors.”

This year was also a record year for BSP Life’s customer benefits payout.

“We paid out a little over $110m, supporting thousands of families to educate their children, plan for retirement, establish businesses, and of course, meet important cultural and family commitments.

“As we celebrate the 150 years of operations in Fiji, this milestone is a testament to the BSP Life’s enduring commitment to championing prosperity for the communities we serve,” Mr Robinson said.

As at the end of March 2024, BSP Life’s investment portfolio stood at $1.1b with returns of more than nine per cent, with the insurance provider targeting to grow its portfolio to $2b.